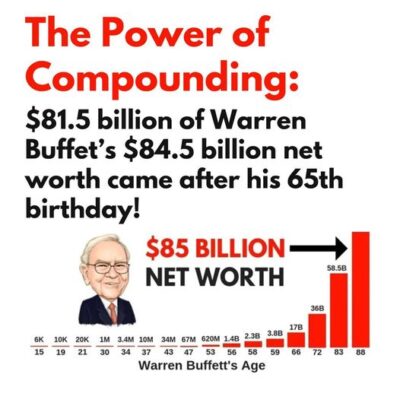

Educate

Learn from our plethora of educational resources so that you are comfortable and confident in your investment decisions.

Invest

Invest in passive income generating multifamily assets with confidence and live life on your terms.

GRow

Grow your investment portfolio confidently through a partnership with Maple Capital Partners.