Are Taxes A Choice?

“In America, there are two tax systems; one for the informed and one for the uninformed. Both systems are legal. Anyone may arrange his affairs so that his taxes shall be as low as possible; he is not bound to choose that pattern which best pays the treasury. There is not even a patriotic duty to increase one’s taxes.”

________________________________________________________________________________

Let’s talk about nobody’s (aside from your tax accountant maybe) favorite topic… taxes. Before you fall asleep in your chair, let’s clarify: we’re going to be looking at the multitude of ways that commercial multifamily real estate can help you pay as little as possible in taxes LEGALLY every year. Got your attention? Great, let’s get started.

Are Taxes A Choice?

It’s been said of the lottery that it’s a tax on ignorance. An ignorance of probability and how the lottery works costs those who buy tickets an estimated $80 billion every year. The financially savvy among us might scoff at this figure. “Stupidity”, they say indignantly. “Who would do such a thing?” they admonish. However, ask these same individuals why they would gladly overpay the Federal Government every year and see how they recoil. The fact of the matter is that ignorance is costly in all forms when it comes to money, whether it be with regards to taxes or the lottery. As Jim Rohn says, “What you don’t know WILL hurt you.” That being said, let’s explore some of the top ways that commercial multifamily real estate investing can allow you to keep more of what you earn every year.

***Short caveat: neither Marc nor Gonzalo are tax accountants, nor do they pretend to be on television. This is for informational purposes only and should NOT be construed as investment, tax, or legal advice. You should consult your tax accountant and/or attorney before taking any action regarding your taxes or investments. That said, we hope you find

this information useful.

What Are the Tax Advantages of Investing in Commercial Multifamily Real Estate?

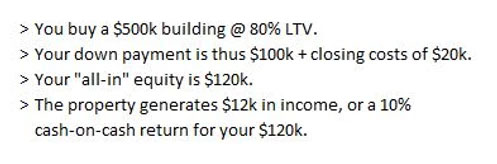

1. Depreciation: First off, what is depreciation? Put simply, depreciation is an accounting treatment that allows property owners to deduct a portion of their physical assets (read: NOT land) to account for the fact that these structures break down as time goes on. Why does this matter? Because that deduction can help you avoid paying taxes on the income from your real estate portfolio. This is both extremely commonplace and very legal. See below for an illustration of how: Initial Assumptions: ***Note: LTV stands for Loan-To-Value. For example, purchasing a $100k house at 80% LTV would mean you received a loan for 80% of the value or $80k.

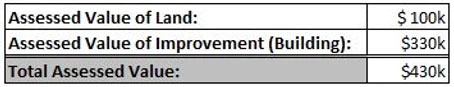

Now, let’s say that your assessed values for tax purposes are the below.

Tax accounting allows you as an investor to straight-line depreciate (think “write down”) the value of your apartment building on a 27.5 year schedule, meaning that every year for the next 27.5 years you can write off $12k ($330k/27.5 yrs) of depreciation. This $12k of depreciation perfectly offsets your $12k of net income to bring your taxable income down to $0. Keep in mind that this is purely tax accounting and has no bearing on the fact that you made $12k of cash-flow essentially tax-free. This is how prominent real estate investors like Steve Schwarzman, Sam Zell, and Donald Trump pay so little in taxes. If anything, this example under-estimates the amount of depreciation an investor would be able to claim. See this or thisvideo for a discussion of the more advanced methods of accelerated depreciation that we employ with our investments.

2. Tax Deductibility of Interest: Tom Wheelright, CPA is one of the most well-known accountants in the nation and is the right-hand man for Robert Kiyosoki, author of “Rich Dad, Poor Dad” and other seminal books on wealth and financial success. We at Maple have read numerous books authored by Wheelright where he states that the tax code is written to encourage/incentivize (“the carrot”) certain types of behavior that the government wants and discourage/dis-incentivize (“the stick”) other types of behavior that the government doesn’t want. This statement is tremendously insightful. From the standpoint of credit, the government wants to encourage you to borrow for things like an education and a house. How do we know? Follow the deductions. As any homeowner can tell you, one of the chief benefits of owning real estate vs. renting is the IRS’s tax treatment of interest: it’s deductible for tax purposes. This same tax benefit is magnified for an investor of larger multifamily property. Imagine getting 5:1 leverage in the stock market and getting REWARDED for borrowing it. That’s exactly the behavior that the government encourages with real estate.

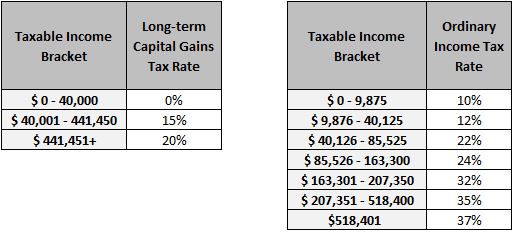

3. Capital Gains Tax Rates: Another example of the tax code’s intention of encouraging certain behavior is the treatment of capital gains vs. ordinary income. For our purposes, ordinary income can be thought of as wage income even though it actually encompasses interest, dividends, royalties, and much more. Basically, it’s the money you receive in exchange for your productivity & time (your human capital). Whereas capital gains is the money you make from the purchase and sale of securities/stakes in businesses. The single-filer ordinary income and capital gains tax brackets are below:

It should be clear from the above figure that, no matter what tax bracket you find yourself in, your long-term capital gains rate will be lower than your ordinary income tax rate. Why is that? To put it simply, the government wants to encourage individuals to invest (long-term preferably) in business ventures. It makes sense. Our entire market-based system, capitalism, is underpinned by the idea that progress is rewarded through investment and profits. Thus the tax code incentivizes investors to stake their capital behind new ideas. This works out well for real estate investors because they’re likely to be taxed on their passive income (what little taxable income is left after deducting the depreciation we addressed above) at lower rates than an active W-2 job! How’s that for a carrot?

We hope that the above items have elucidated the tax benefits of investing in real estate generally, and more specifically how these benefits are multiplied on large multifamily assets. In fact, real estate investors have among the most advantageous treatment under the tax code, and that’s one of the reasons we think commercial multifamily real estate makes such a compelling addition to any investor’s portfolio.